Tax info for 2022 and beyond

The ADA News talked with Allen Schiff, a CPA and Academy of Dental CPAs president, about what's new for 2022 and 2023 when filing your taxes.

New treatment for Research and Development Tax Credit expenses

If your dental practice qualified for the Research and Development Tax Credit, or R&D Credit, be aware that effective Jan. 1, 2022, you could still take the tax credit if your dental practice qualifies, Mr. Schiff said. However, under the Tax Cuts and Jobs Act of 2017 — also known as the new tax law — dentists will have to capitalize such costs and amortize them over a five-year period. As a result of this change in the tax law, this is how the amortization schedule of the 2022 R & D costs will look over the next five years.

Small employer pension plan start-up changes

The Setting Every Community Up for Retirement Enhancement Act 2.0, or SECURE Act 2.0, was updated and signed into law in 2022. This law offers a tax credit to help dental practices that set up a new retirement plan for 2022. Dentists who started their practice’s first SIMPLE or 401(k) plan in 2022 and have less than 100 employees can qualify for a tax credit of at least $500 tax credit up to a maximum of $5,000 for each of the first three years of the new plan. This tax credit can be applied to 50% of qualified business’ SIMPLE or 401(k) costs such as plan setup and administration. Remember: For tax purposes, a tax credit is better than a tax deduction.

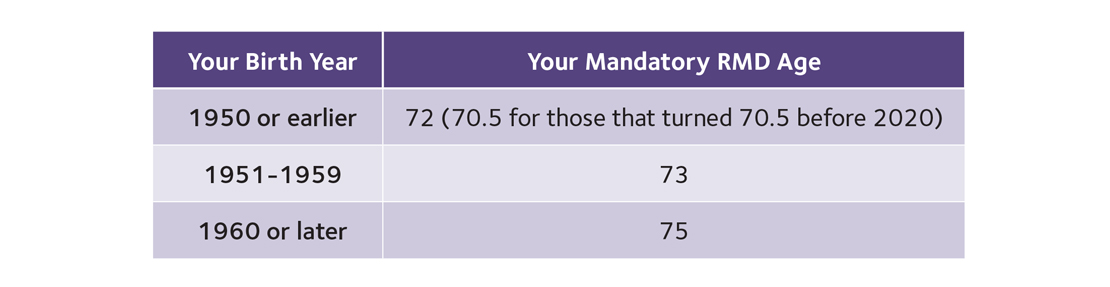

Required minimum distributions

The SECURE Act 2.0 also creates new strategies for required minimum distributions. When do I have to take my taxable required minimum distribution? – For your first required minimum distribution, the tax deadline is April 1 of the year following you reach your required minimum distribution Age, Mr. Schiff said. Please see the chart below for when you have to take your RMD.

Restaurant meal expenses

Restaurant meal expenses are no longer 100% deductible. This was a special tax law for 2021 and 2022 to help the restaurant industry recover during the pandemic. Effective, Jan. 1, business meal expenses are now subject to the pre-COVID-19 Law, which is 50% deductible.

Solar tax credit increase

As a result of the Inflation Reduction Act of 2022, the tax credit for installing solar panels on a residence has been increased from 22% to 30% of the cost of the installation. This credit is effective until 2032.

Things to keep in mind for 2023

Tax credit for purchasing an electric vehicle

Effective Jan. 1, there is no longer a cap limit on the $200,000 manufacturing threshold for car manufacturers of EVs. In addition, if the vehicle does not cost more than $55,000, the tax credit will apply. In addition to the cost of the vehicle, your modified adjusted gross income must be less than $150,000 for individuals and $300,000 for married filing jointly. Finally, the final assembly of the vehicle needs to take place in North America.

Bonus depreciation deduction set to change in 2023

This is the last year the bonus depreciation deduction will be 100%. Under the new tax law, dentists could deduct 100% of the dental equipment you purchased in the year of acquisition for the period of Sept. 27, 2017, to Dec. 31, 2022. Effective Jan. 1 , the 100% bonus percentage has been reduced to 80% for all of 2023.

2023 standard mileage rates

If you use your personal automobile for business use within your dental practice, you can now deduct 65.5 cents per mile, effective Jan. 1. To do this, it’s imperative you maintain an auto log on a daily basis in order to support the business miles you are driving on behalf of your practice. For example, if your business miles in 2023 amount to 4,000 miles, you will be able to deduct $2,620 in auto expenses in 2023. (4,000 miles x 65.5 cents / mile).

Charitable deductions

For 2023, the standard deduction has been increased by $1,800 to $27,700 (married filing joint). When you file your individual tax return for 2023, you will be entitled to the greater of the standard deduction ($27,700) or your itemized deduction. If your itemized deductions are approximating the standard deduction, a tax strategy to consider would be “bunching” your charitable deductions every other year, thereby creating a higher deduction other than the given standard deduction. Bunching is a concept whereby you pay for two years charitable contributions in one year.

For more information or to find a dental CPA, visit the Academy of Dental CPAs at ADCPA.org .

Note:

The information in this piece is not intended to be, nor should it be construed as, tax, accounting or legal advice. Readers are urged to consult a qualified professional when seeking such advice. The ADA makes no endorsement of the above advice, nor of any website or organization mentioned in the above piece.